Total AUM

₹12.03 crores as of Jan 31, 2026

Age of Fund

4 months since Oct 10, 2025

Exit Load

Nil

Goal of Investment

Capital Growth & Income

Ideal holding period

10 Years+

| Large Cap | 71.6% |

| Mid Cap | 11.5% |

| Small Cap | 16.7% |

| Top Holdings | Weight % |

|---|---|

| Bharat Electronics Limited | 7.7 % |

| Tech Mahindra Limited | 7.4 % |

| Nestle India Limited | 7.1 % |

| HCL Technologies Limited | 7.0 % |

| Hindustan Unilever Limited | 6.9 % |

| Infosys Limited | 6.7 % |

| Tata Consultancy Services Limited | 6.5 % |

| Asian Paints Limited | 6.0 % |

| Maruti Suzuki India Limited | 6.0 % |

| ITC Limited | 5.4 % |

| View All Holdings | 66.7 % |

| Credit rating profile | Weight % |

|---|---|

| Cash & Equivalent | 0.3 % |

| Instrument break-up | Weight % |

|---|---|

| TREPS | 0.2 % |

| Top Holdings | Weight % |

|---|---|

| TREPS / Reverse Repo Investments | 0.2 % |

| Cash & cash equivalents | 0.1 % |

| 0.3 % |

Tracking Error

0 %

Tracking Error (Abs.)

0 %

Note: Under SEBI regulations, the performance of this scheme can’t be displayed as it has been in existence for less than 6 months.

Anil Ghelani, CFA

Diipesh Shah

The investment objective of the Scheme is to generate returns that are commensurate with the performance of the Nifty500 Flexicap Quality 30 Index, subject to tracking error.

There is no assurance that the investment objective of the Scheme will be achieved.

An open ended scheme replicating / tracking Nifty500 Flexicap Quality 30 Index.

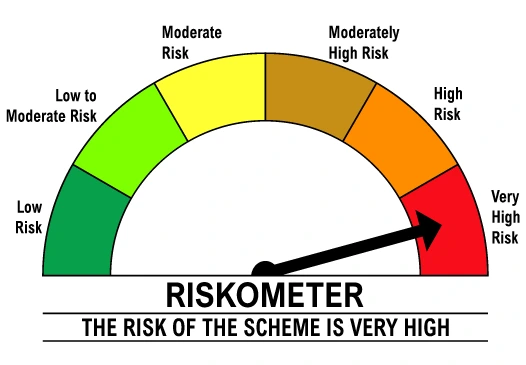

Level of Risk in the Scheme

Other Information

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| More than 12 months | Long term | 12.5 % |

| 12 months or less | Short term | 20 % |

Mutual fund taxation is based on the fund’s taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide